Net profit percentage formula

Calculate the cost price of the table. Net profit is the amount of money your business earns after deducting all operating interest and tax expenses over a given period of time.

Net Income Formula Calculation And Example Net Income Income Accounting Education

Using the Profit Percentage Formula Profit Percentage ProfitCost Price 100.

. Relevance and Use of Profit Percentage Formula. The formula for gross margin percentage is as follows. Ie 20 means the firm has generated a.

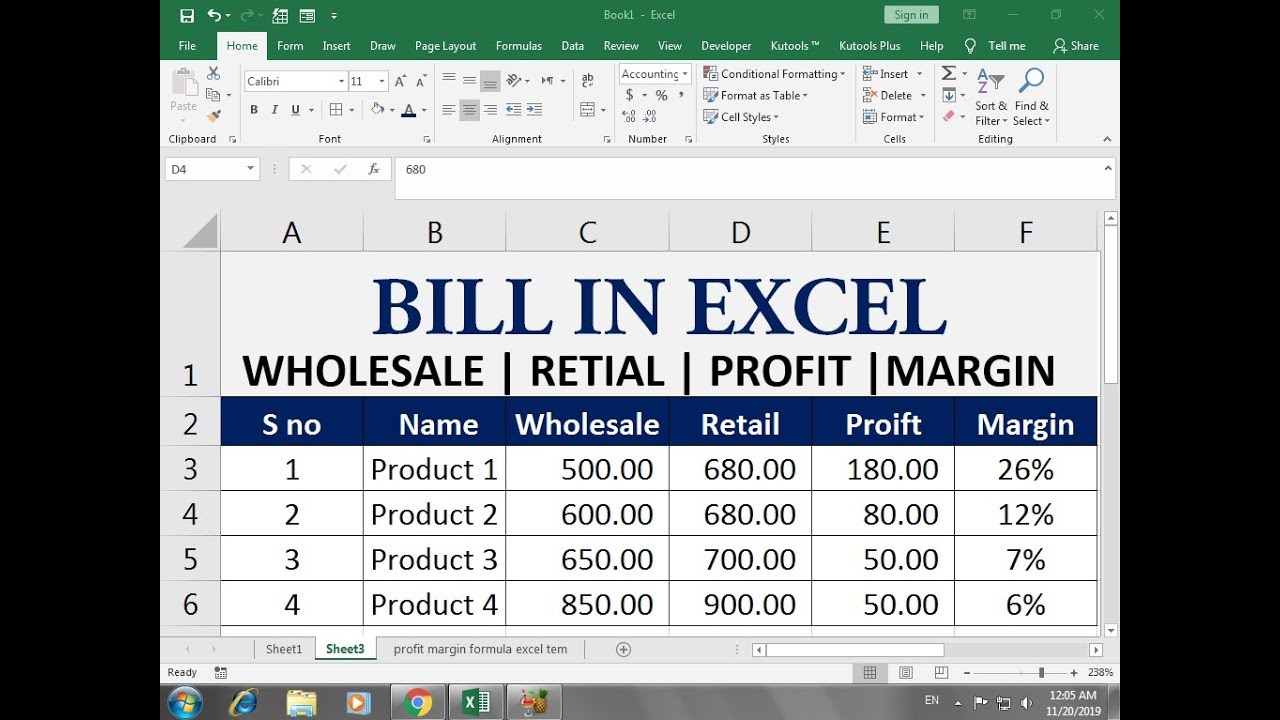

Each item in the table has different price and cost so the profit varies across items. Markup Percentage Formula Markup in very simple terms is basically the difference between the selling price per unit of the product and the cost per unit associated in making that product. Determine the gross profit.

Profit Percentage Markup Net Profit SP. Profit Percentage Margin Net Profit SP CPSelling Price SP X 100. When gross profit ratio is expressed in percentage form it is known as gross profit margin or gross profit percentage.

The goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Profit Percentage 525 100 20. Net profit margin is profit minus the price of all other expenses rent wages taxes etc divided by revenue.

The income statements aim is to show managers and investors whether the business made money profit or lost money loss during the time span under. The profit equation is. Learn how to use the profit formula which delivers a solid percentage of profit to help measure your companys worth and determine if its successful.

In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. In the example shown the formula in E5 copied down is. This measurement is typically made for a.

Profit percentage is a top-level and the most common tool to measure the profitability of a business. After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. The formula of gross profit margin or percentage is given below.

Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000. On selling a table for 840 a trader makes a profit of 130. Why Net Profit Margin Is Important.

Where P is the profit and CP is the cost price. Gross_margin 100 profit revenue when expressed as a percentage. When a business subtracts all its costs from its generated revenue they are left with its net profit.

Net profit margin is the ratio of net profits to revenues for a company or business segment. Net profit margin is the percentage of revenue left after all expenses have been deducted from sales. Once the profit is calculated we can also derive the percentage profit e have gained in any business by the formula given here.

Lets understand the application of these formulae with the following simple example. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales. Its the most vital component of an income statement and what.

This results in a net sales revenue of 162000. Presentation of Net Profit Margin. Gross profit is equal to net sales minus cost of goods sold.

In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20. Net margin is a ratio that is typically expressed as a percentage though it may also be listed in decimal form. Gross profit percentage formula Total sales Cost of goods sold Total sales 100.

Net Profit Margin Formula. The measurement reveals the amount of profit that a business can extract from its total sales. In other words given a.

Profit Percentage fracProfittextCost Price x 100. Investors are typically interested in gross profit margins as a percentage because this shows them to compare margins between peer companies no matter their sales volume or size. To calculate the percentage discount from an original price and a sale price you can use a formula that divides the difference by the original price.

It shows how the revenues are converted into net income or net profit. Profitability is a measure of efficiency and it is useful in determining the success or failure of a business. There are three types of profit used in business.

Typically expressed as a percentage net profit margins show how much of each dollar collected by a. For example an investor. So basically it is the additional money over and above the cost of.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. It measures the ability of the firm to convert sales into profits. To calculate the profit percentage you will need the below-mentioned formula.

Net profits Net sales x 100 Net profit margin. These resources account for the cost of goods sold COGS that companies depend on for operational processes. The formula of profit percentage is given as follows.

More simply the net profit margin turns the net profit or bottom line into a percentage. In the formula this value substitutes as. Think of it as the money that ends up in your pocket.

There are two main reasons why net profit margin is useful. A vendor purchased a book for 100 and sold it for. Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to.

P PCP 100. Net margin also called net profit margin measures how much profit or net income is earned as a percentage of overall revenue. Therefore the profit earned in the deal is of 5 and the profit percentage is 20.

The gross profit percentage measures how efficiently companies allocate resources to create and sell products. Profit margin is calculated with selling price or revenue taken as base times 100. Is a relative number a percentage which is equal to the ratio between profit and revenue.

Using the above formula Company XYZs net profit margin would be 30000 100000 30.

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverag Contribution Margin Financial Management Fixed Cost

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Being A Landlord Rental Property Management

Pin On Bookkeeping Basics

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

Pin On Airbnb

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator